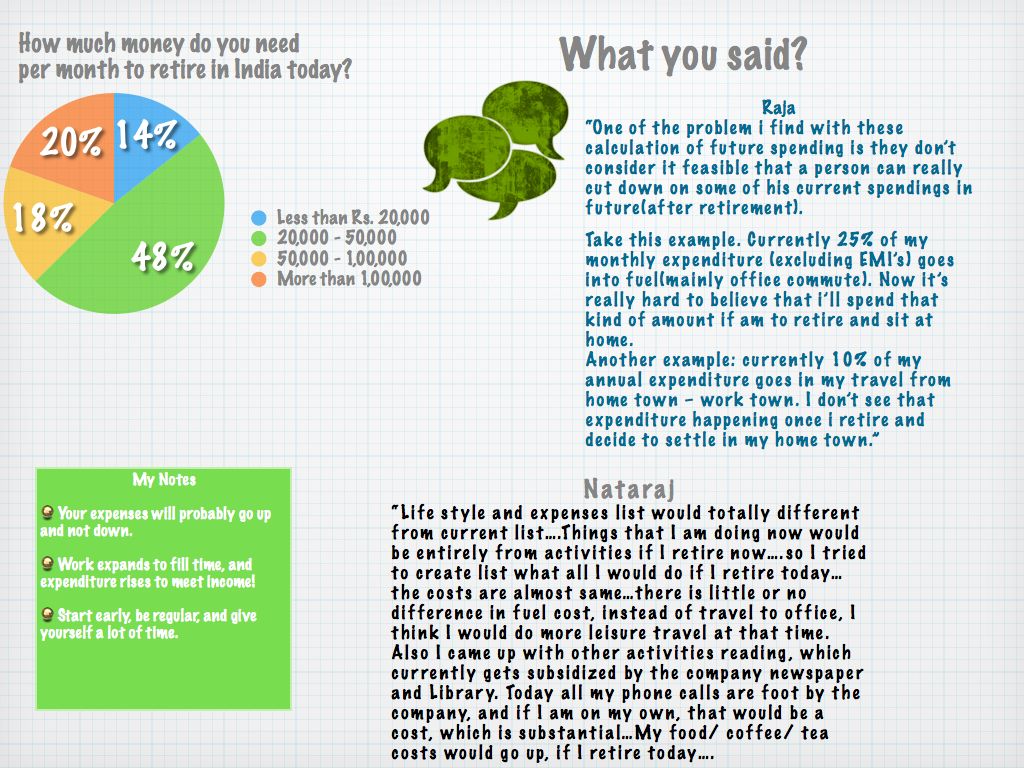

In the last poll I had asked you how much money do you need per month to retire in India today, and 48% of you (190 votes) said between Rs. 20,000 and Rs. 50,000. To my surprise, the next biggest segment was the more than Rs.1,00,000 segment with 20%, and you can see the rest of the results below.

(click for bigger image)

In this post, I am going to be what I think is called a party pooper, and say that a lot of you believe that you’ll need lesser money than you spend today during your retirement, but you are probably wrong.

For starters, if you’re salaried and not in your forties yet, then you are probably far away from what is going to be your peak income. Your income might look like a reasonable sum to you today, but wait till you start making a lot more, and see Parkinson’s second law kick into effect:

expenditures rise to meet income

Now it’s true that you will have more responsibilities at that time than today, and a lot of those will not be present during your retirement, but it’s just as likely that there are some unforeseen liabilities as well; how is that percentage going to work out? How do you calculate something like that anyway?

Next up, when you think that you will need lesser money during retirement than today, that automatically implies that you need to save less today, and that in turn implies more money to splurge; think about it – aren’t you much more likely to lull yourself into making some assumptions that make spending easier today? After all, delayed gratification is hard, really hard.

That said, I believe that a lot of you are way ahead of the game just by thinking about retirement, and planning for retirement. Starting retirement planning early means that you develop a long term approach to retirement, think about various alternatives where you can invest your money, not fall in credit card debt, and give yourself the benefit of compounding which makes a huge difference.

As long as you are not looking at huge debt, saving a decent amount by being frugal (but not stingy), and making good investment habits, whatever your number is – you will be alright.

So don’t fret too much about the number, which is too far out in the future, and so variable that it’s hard to predict, and focus instead on developing good financial habits. And thank you all for your wonderful comments!

To open an NPS account you just need to visit Head Postoffice of your nearest city.

Iam not sure if what we do is saving since most of our salary goes into EMI paying (2 home loan and a Car loan). Since a house can be considered an asset and since most of our income goes into paying EMI for it we can consider it as saving. And the rest of the money we accumulate and goes into paying off the home loan. Here and there when a good IPO comes or for tax saving we put our money into mutual funds and IPOs.

Mansu:

I can give you a comparison between Mangalore and Bangalore. With house being taken care of in both places, Mangalore still works out about 20-30% cheaper to live.

Here are the things that makes the biggest difference.

1. Eating out: Bangalore is about 60-70% more expensive for similar quality eateries (Especially ice-creams).

2. Transportation: In Bangalore even your regular shopping commutes and other leisurely commute can quickly add up. You’ll spend about double of what you’d spend in Mangalore on Fuel bills.

3. Entertainment: You have so many options in and around a small town, within 1hr of driving distance. If you have relatives it is even better. A Bangalore entertainment outing is bloody expensive. Getting out of and in-to Bangalore is an experience in itself.

4. Services: Sevices like Electrical, Plumbing, driving etc. are easily 20-30% cheaper.

5. Local veggies are cheaper, though fruits cost the same.

Overall living would be about 20% cheaper. As you said biggest factor is indeed the house. If you have a house the difference in cost may not be as much, but quality of life is certainly better in smaller towns.

Wow! That’s quite a difference even without the rent…what do you think will happen if we were to include rent in these calculations?

don’t u think it again depends on which part of India we r talking abt?

Yeah, that’s a factor as well, esp if you’re paying rent which can then form a major part of your expenses. But minus rent, I wonder how much of a difference it really makes. It must be more expensive staying in Mumbai than it is to stay in Bhopal, but if you remove rent, how much else of a difference it makes then. Maybe someone who has lived in a big and small city recently can tell us.