I was looking at India’s External Debt for December 2010 (pdf), and came across several things that I didn’t know about earlier.

So, I thought I’d write about them and here is a post with some interesting aspects about India’s external debt.

Government versus Non- Government Debt

When we talk about India’s external debt – the fact that only a part of this debt is owed by the government is not very apparent. Even though you regularly read that private companies are raising foreign currency debt – when you read news reports about India’s external debt rising – the fact that this could be because of the private sector doesn’t come to mind so quickly.

India’s foreign external debt for Dec 2010 stood at $297.51 billion, and the share of government debt in it is 25%, and non – government debt is 75%.  So, government debt is significantly lesser than private debt.

Different Categories of Debt

Different countries categorize their debt in different ways and India has seven heads under which it classifies its long-term external debt, and then it has one head for the short-term debt.

Here are the heads as well as numbers for the Dec 2010 quarter:

| S.No. | Head | Amount as on Dec 2010

In Millions USD |

| 1 | Multilateral | 47,608 |

| 2 | Bilateral | 25,207 |

| 3 | IMF | 6,127 |

| 4 | Export Credit | 18,955 |

| 5 | Commercial Borrowings | 84,676 |

| 6 | NRI Deposits | 50,672 |

| 7 | Rupee Debt | 1,646 |

| Total Long Term Debt | 234,891 | |

| 8 | Short Term Debt | 62,620 |

| Grand Total | 297,511 |

As you can see a large part of the external debt is long term in nature, and within that commercial borrowings form the majority followed by NRI Deposits and Multilateral debt.

I didn’t realize that some part of India’s external debt  is denominated in INR, and the explanation I got from the document is that the Rupee denominated debt showed in this table is owed to Russia and is payable through exports.

However, what you see in this table is a very small percentage of the total Rupee denominated debt, and after the USD – Rupee is the currency in which India owes most of its external debt!

Currency Composition of External Debt

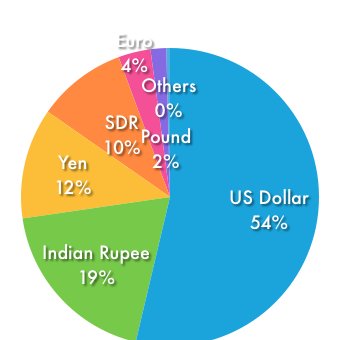

Not surprisingly, USD makes up 53.3% of the external debt, but I was really quite surprised to see that the next currency was the Indian Rupee itself!

I certainly didn’t realize that India has borrowed so much from foreigners in its own currency, as about 19% of our external debt is denominated in INR.

Here is pie chart that shows the break – up on external borrowing.

The fact that INR made so much of our debt amazed me and I dug a little more to see why that is the case.

I found an explanation of this in a report named India’s External Debt: A Status Report 2009 – 10 (pdf) and here’s what I found.

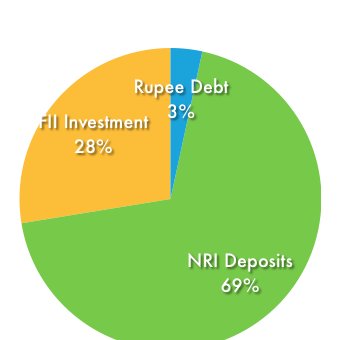

The Rupee denominated debt has four components:

- Rupee debt: This is something we owe to Russia from the times of the old USSR and is not a whole lot in value.

- Rupee Denominated NRI Deposits: The money NRIs keep in NRO and NRE account.

- FII Investments in Government Treasury Bills

- FII Investments in corporate debt securities

For the period ending March 2010 – the relative percentages for these were as follows:

What’s really interesting about this debt is that although it’s owed in a foreign currency – the effect of exchange rate movement is the opposite on this type of debt when compared with other external debt.

Normally, if you borrow in a foreign currency, and your currency depreciates that’s bad for you. For example: if you borrow $100 from your cousin in the US at an exchange rate of 1 USD to Rs. 50, you will get Rs. 5,000.

But, if at the time of repayment 1 USD = Rs. 100 then you will have to spend Rs. 10,000 to buy $100 and you’re at a loss because your currency depreciated.

However, if your cousin opened a NRO account with $100 – he gets Rs. 5,000 in his account. If after a year he wants to repatriate his INR into USD he will get an exchange rate of 100 rupees to a Dollar, and his Rs. 5,000 will only fetch him $50!

Conclusion

Looking at this foreign debt data was quite a useful exercise for me because I had never looked at the numbers in detail, and this reading will certainly change the way I look at the debt numbers whenever they are reported the next time!

Thanks for external Indian debt in briefly.

Thanks for your detailed and analytical write-up on India’s external debt.

Thank you for your comment!